Plutus – Leading Japanese M&A and Valuation Advisory Firm

- Plutus is an independent Japanese financial advisory service firm that specializes in Mergers & Acquisitions, Fund Raising, and Valuations.

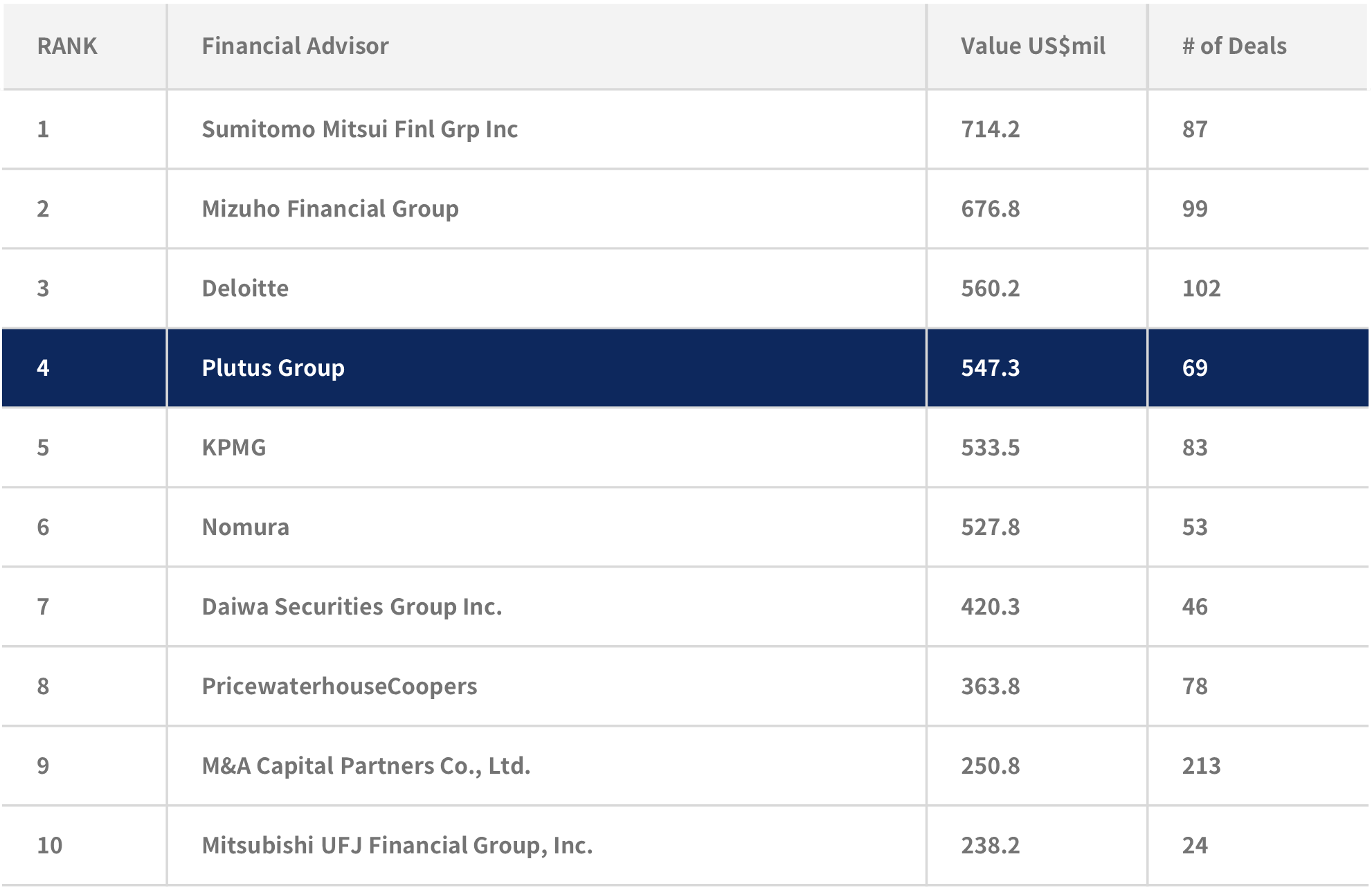

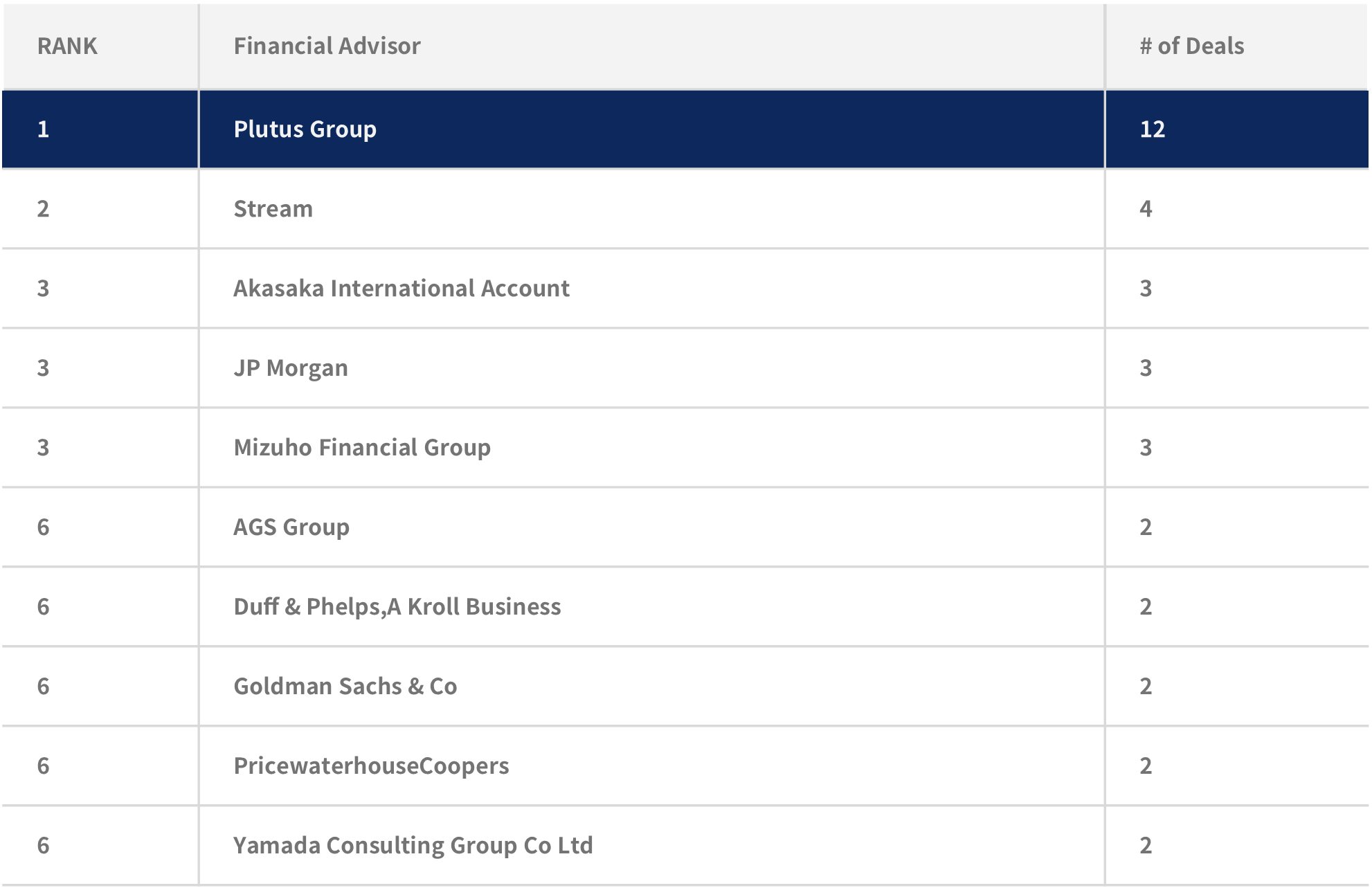

- Plutus is among the top-tier M&A advisory firms in Japan

Japan Mid-Market M&A Financial Advisory Review Full Year 2025

Source: LSEG

Japan Fairness Opinion Financial Advisor Rankings Full Year 2025

Source: LSEG

Plutus – Strong Japanese Client Base

Client relationships with + 1,000 Japanese Companies

Plutus – Representative Transactions

June 2025

Provision of Advice and Valuation of Share Delivery Ratio for the Business Integration of Hino Motors, Ltd. and Mitsubishi Fuso Truck and Bus Corporation

In regard to the business integration of Hino Motors, Ltd. (TSE Prime 7205) and Mitsubishi Fuso Truck and Bus Corporation, and in connection with the four companies, including their respective parent companies, Toyota Motor Corporation (TSE Prime 7203) and Daimler Truck AG, entering into a business integration agreement, we were appointed as a financial advisor and a third-party valuation institution to the special committee established by Hino Motors, Ltd.. We provided advice on making Mitsubishi Fuso Truck and Bus Corporation a subsidiary through share delivery and also performed a valuation of the share delivery ratio.

June 2025

Provision of advice, share valuation and fairness opinion on the share repurchase and subscription for preferred shares by Toyota Motor Corporation

In connection with the transaction aimed at privatizing Toyota Industries Corporation (TSE Prime 6201), Toyota Motor Corporation (TSE Prime 7203) planned to acquire its own shares and subscribe for preferred shares. To avoid conflicts of interest with Mr. Akio Toyoda and ensure fairness, Toyota Motor Corporation established an Advisory Committee. As a financial advisor to this committee, we provided advice and, as a third-party valuation institution, assessed the value of the preferred shares and submitted a fairness opinion on the appropriateness of the paid-in price.

May 2025

Provision of Advice, Share Valuation and Fairness Opinion on a Tender Offer for the Purpose of Making NTT DATA Group Corporation a Wholly-Owned Subsidiary by NIPPON TELEGRAPH AND TELEPHONE CORPORATION

In connection with the tender offer for common shares conducted by NIPPON TELEGRAPH AND TELEPHONE CORPORATION (TSE Prime 9432) for the purpose of making its consolidated subsidiary, NTT DATA Group Corporation (TSE Prime 9613), a wholly-owned subsidiary, we provided advice as a financial advisor to the special committee established by NTT DATA Group Corporation to ensure fairness and avoid conflicts of interest, assessed the stock value as a third-party valuation agent, and submitted a fairness opinion regarding the fairness of the tender offer price.

June 2024

Provision of Advice, Share Valuation and Opinion in the Tender Offer for FANCL Corporation by Kirin Holdings Company, Limited

In connection with the tender offer by Kirin Holdings Company, Limited (TSE Prime 2503) for the purpose of making FANCL Corporation (TSE Prime 4921) a wholly-owned subsidiary, we provided advice as a financial advisor to the special committee established by FANCL Corporation to ensure fairness and avoid conflicts of interest. We also calculated the share value as a third-party valuation institution and submitted a fairness opinion regarding the fairness of the tender offer price.

August 2023

Calculation of Stock Value and Expression of Opinion in the Tender Offer Premised on the Privatization of ITOCHU Techno-Solutions Corporation by ITOCHU Corporation

In connection with the tender offer for common shares by ITOCHU Corporation (TSE Prime 8001) premised on making ITOCHU Techno-Solutions Corporation (TSE Prime 4739) a wholly-owned subsidiary, we provided advice as a financial advisor to the special committee established by ITOCHU Techno-Solutions Corporation, calculated the stock value as a third-party valuation agent, and submitted a fairness opinion regarding the fairness of the tender offer price.

May 2020

Calculation of Stock Value and Opinion Statement on a Tender Offer for the Purpose of Making Sony Financial Holdings Inc. a Wholly-Owned Subsidiary by Sony Corporation

In a tender offer for common shares conducted as part of making Sony Financial Holdings Inc. (TSE First Section 8729) a wholly-owned subsidiary by Sony Corporation (TSE First Section 6758), we were appointed as the financial advisor and third-party valuation institution for the special committee established by Sony Financial Holdings Inc. to ensure fairness and avoid conflicts of interest. We conducted a valuation of the stock value and submitted an opinion (a fairness opinion) on the fairness of the tender offer price.

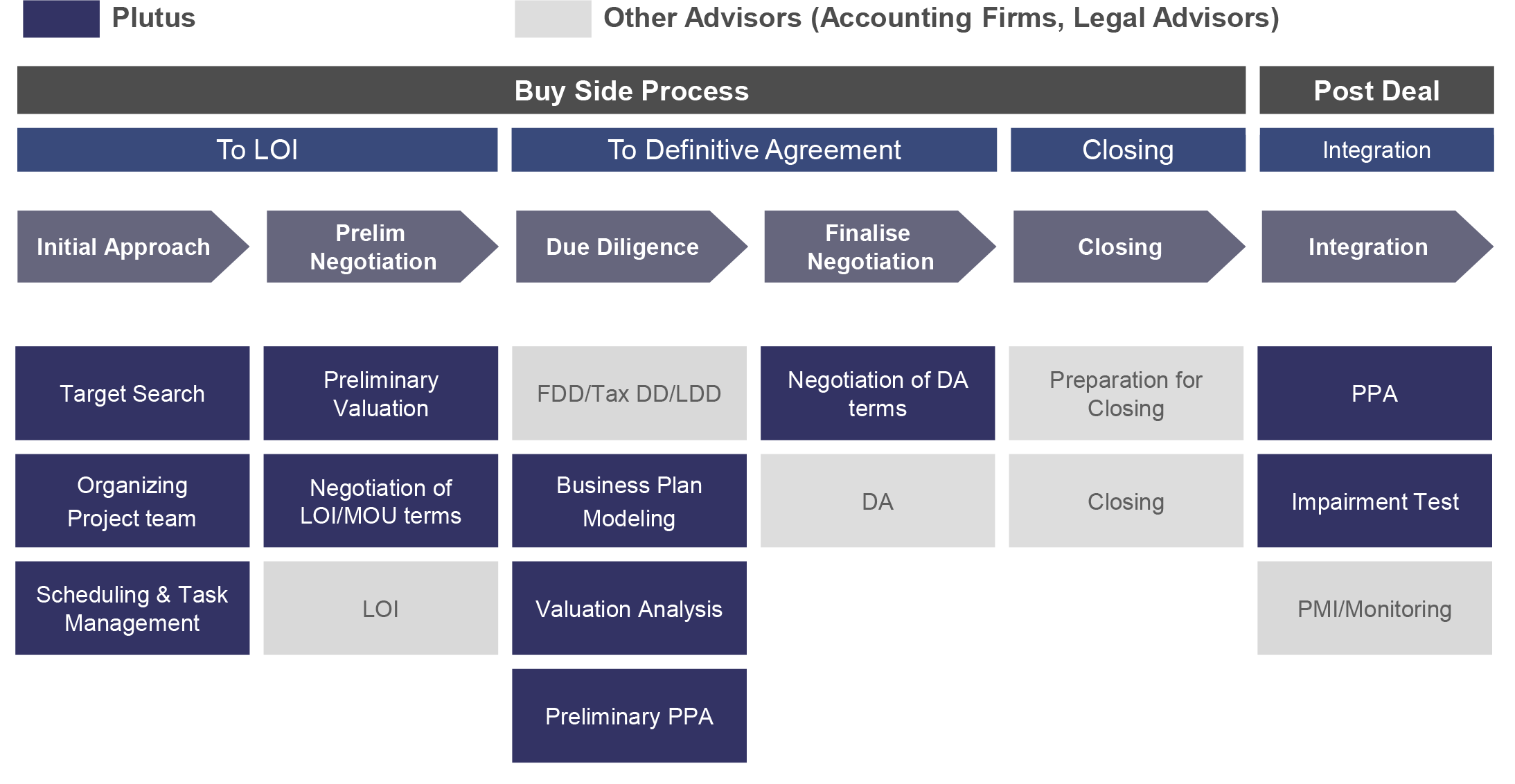

Plutus – Overview of our Services

*Buy side process

Automotive

Automotive IT & Telecoms

IT & Telecoms Lifestyle & Consumers

Lifestyle & Consumers Finance

Finance